Apartments.com Publishes Multifamily Rent Report for First Quarter of 2024

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240404033182/en/

The

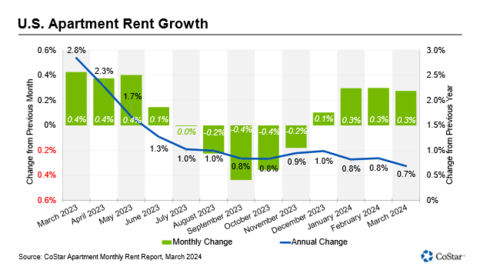

The national average annual asking rent rose by 0.7% in March compared to 0.8% in the two prior months. Since mid-2023, annual rent growth has been hovering around 1% after rapid deceleration in 2021 and 2022. Month-over-month rent growth was 0.3% in all three months of the quarter.

Midwest and Northeast markets have avoided oversupply conditions and maintained solid rent growth over the year at 2.2% and 1.3%, respectively. Markets in the West closely matched the nation as weak demand mixed with limited completions have kept rent growth restrained but positive. Still, continued oversupply conditions in the South have kept rent growth in negative territory.

At 3.4%,

At the opposite end of the scale, rents fell by 5.7% over the past 12 months in

Absorption was led by 4&5-Star units, with just over 88,000 units in the quarter. But with most new supply aimed at the luxury market, annual asking rent growth remained negative in that segment and finished March at -0.3%. This decline contrasts with mid-priced assets that benefited from rising demand for 3-Star properties, where net absorption increased from 10,000 units in the fourth quarter of 2023 to 27,000 units in the first quarter of 2024, helping keep rent growth positive at 1.3%. Improving consumer confidence, lower inflation, and sustained economic expansion all helped boost 3-Star demand.

Demand for 1&2-Star properties remains the weakest of all market segments, with two and a half years of negative absorption. Households at this price point struggle with higher housing costs and the elevated costs of everyday items, pushing some to seek alternative housing solutions such as moving in with roommates or returning to the family home.

After completions of multifamily units reached a 40-year record in 2023, this year may offer the multifamily market a chance to catch its breath. The multifamily market is projected to add only 495,000 units in 2024, a 20% pullback from the prior year. However, property operations going into 2024 could vary widely depending on the market and the price point. Markets in the South and luxury properties remain most at risk for weakness throughout 2024 due to oversupply conditions, while Midwest and Northeast locations and mid-priced 3-star properties could outperform.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the

View source version on businesswire.com: https://www.businesswire.com/news/home/20240404033182/en/

(202) 346-6775

mblocher@costargroup.com

Source: